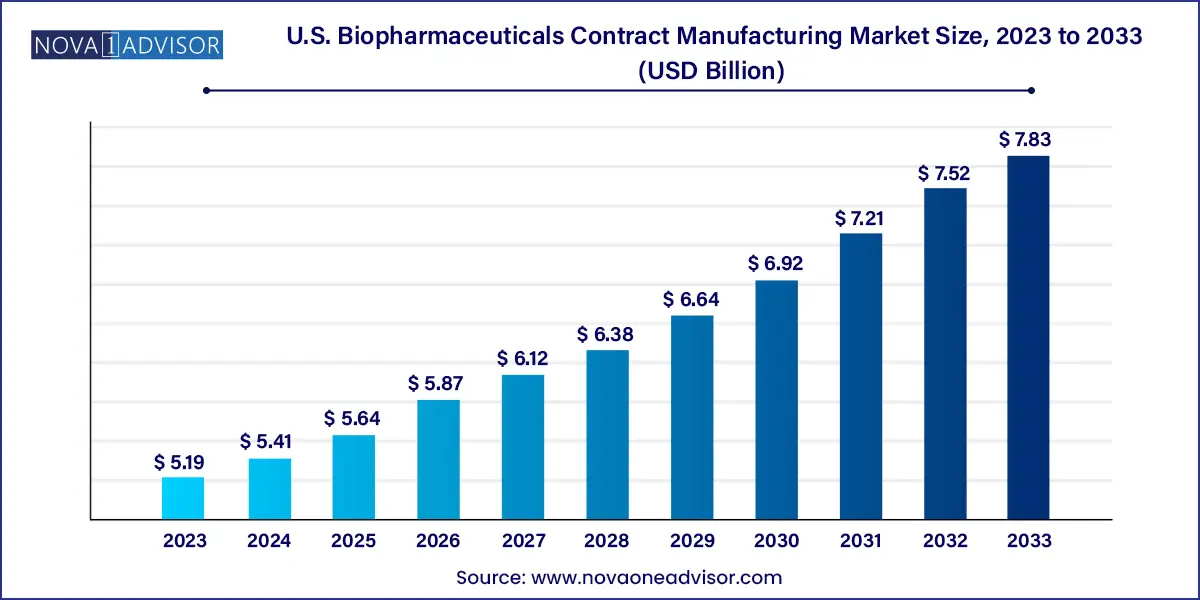

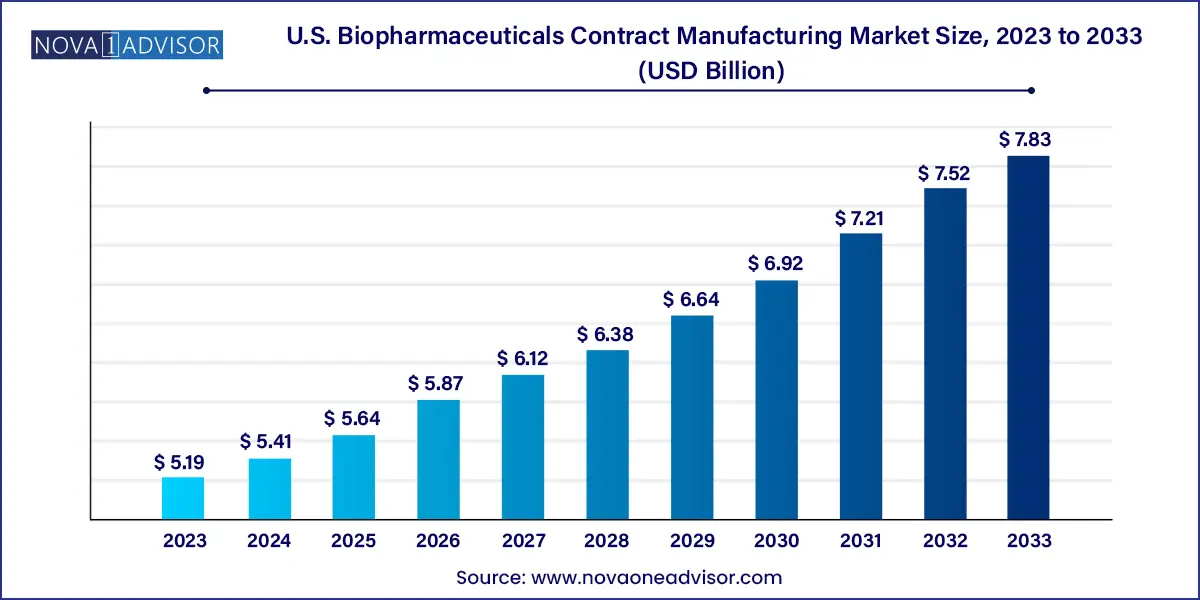

The U.S. biopharmaceuticals contract manufacturing market size was estimated at USD 5.19 billion in 2023 and is expected to surpass around USD 7.83 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 4.2% during the forecast period 2024 to 2033.

Key Takeaways:

- The mammalian source segment accounted for the highest share of 56.19% in 2023.

- The non-mammalian segment is anticipated to witness the fastest CAGR during the forecast period.

- Process development services led the market in 2023 and accounted for a share of 32.11%.

- The analytical & QC studies segment is anticipated to witness the fastest CAGR from 2024 to 2033.

- The biologics product segment led the market in 2023, with a share of over 81.18%.

- The biosimilar segment is expected to witness a significant growth from 2024 to 2033.

Market Overview

The U.S. biopharmaceuticals contract manufacturing market has evolved into a critical pillar within the pharmaceutical value chain, driven by the increased demand for biologics, the complex nature of biopharmaceutical production, and the necessity for specialized infrastructure. As the pharmaceutical industry continues to shift toward biologically-derived drugs such as monoclonal antibodies, recombinant proteins, and nucleic acid-based therapies, the reliance on contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) has intensified.

Biopharmaceutical production requires advanced technical expertise, high capital expenditure, stringent regulatory compliance, and substantial operational scalability. For many biopharma companies—particularly small and mid-sized firms the decision to outsource manufacturing to contract partners is not only strategic but economically viable. The U.S. offers a favorable landscape for this industry due to its robust regulatory framework, advanced biotechnology ecosystem, and strong intellectual property protection laws.

Moreover, as the pharmaceutical pipeline increasingly includes cell and gene therapies, biosimilars, and other complex molecules, specialized contract manufacturers are stepping in to offer end-to-end services. From early-phase development and analytical testing to large-scale commercial production and fill-finish operations, contract manufacturing has become integral to the successful delivery of therapies to market.

Major Trends in the Market

-

Diversification of Service Offerings

CMOs are expanding their capabilities to provide integrated solutions, including process development, formulation, analytical testing, and final packaging, streamlining timelines for their clients.

-

Growth of Personalized Biologics

With the rise of precision medicine, there’s increasing demand for small-batch, flexible manufacturing tailored to individual patients or narrow populations.

-

Adoption of Modular and Single-use Technology

Biopharmaceutical manufacturers are increasingly employing modular production facilities and single-use bioreactors to enhance flexibility and reduce cross-contamination risks.

-

Consolidation Among Contract Manufacturers

Mergers and acquisitions among CMOs/CDMOs are leading to larger entities capable of offering comprehensive and global service portfolios.

-

Emphasis on Speed to Market

Given the competitive nature of biologics and biosimilar launches, reducing manufacturing turnaround times is becoming a key differentiator among service providers.

-

Regulatory Harmonization Efforts

Efforts by U.S. regulatory bodies to streamline approvals and provide clearer guidelines for biologics and biosimilars are enhancing confidence in outsourced manufacturing.

U.S. Biopharmaceuticals Contract Manufacturing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 5.41 Billion |

| Market Size by 2033 |

USD 7.83 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.2% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Source, service, product |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Lonza; WuXi Biologics; FUJIFILM Diosynth Biotechnologies U.S.A., Inc.; Boehringer Ingelheim; Thermo Fisher Scientific Inc.; Samsung BioLogics; AGC Biologics; Catalent Pharma Solutions; Rentschler Biopharma SE; Eurofins Scientific SE |

Key Market Driver: Expansion of Biologics Pipelines

One of the most compelling growth drivers for contract manufacturing in the U.S. biopharmaceutical industry is the relentless expansion of biologics pipelines. Both emerging biotech firms and large pharmaceutical players are heavily investing in biologics due to their high efficacy, especially for chronic and complex diseases like cancer, rheumatoid arthritis, and autoimmune disorders.

However, biologic manufacturing is inherently more complex than small molecule production. It involves cell-line development, precise environmental controls, and highly regulated bioprocessing environments. For many companies, building this infrastructure in-house is not only costly but also inefficient. By outsourcing production to specialized CMOs/CDMOs, they gain access to state-of-the-art technologies, specialized personnel, and regulatory expertise, thereby accelerating time-to-market while maintaining product quality.

Key Market Restraint: Technical and Quality Risks in Outsourcing

Despite its advantages, outsourcing biopharmaceutical manufacturing carries inherent risks, particularly concerning quality control and process reliability. A single misstep in maintaining sterility or batch consistency can lead to production delays, regulatory hold-ups, or even product recalls.

Furthermore, the transfer of knowledge between the biopharma innovator and the contract manufacturer is a complex and sensitive process. Miscommunication or inadequate technology transfer protocols can hinder scalability and repeatability. Additionally, companies risk losing operational oversight, which can impact intellectual property security or product differentiation in competitive therapeutic areas.

Key Market Opportunity: Emergence of RNA and Gene-Based Therapies

The burgeoning field of RNA-based therapeutics, including mRNA vaccines, siRNA, antisense oligonucleotides, and gene therapies, presents a substantial opportunity for the contract manufacturing industry in the U.S. These therapies are gaining traction in areas such as oncology, rare genetic disorders, and infectious diseases.

Most biopharma companies exploring these novel modalities lack the manufacturing infrastructure and technical expertise to handle their complex production requirements, such as encapsulation technologies, advanced purification methods, and ultra-cold chain logistics. Contract manufacturers that invest in these capabilities such as lipid nanoparticle formulation, plasmid DNA production, or viral vector manufacturing are well-positioned to capture future growth in these next-generation therapeutic categories.

Segments Insights:

By Source Insights

Mammalian cell-based production remains the dominant source in the U.S. biopharmaceutical contract manufacturing market, primarily due to its suitability for producing complex biologics that require post-translational modifications. These include monoclonal antibodies and recombinant proteins used in cancer immunotherapies and autoimmune diseases. Mammalian systems, such as CHO (Chinese Hamster Ovary) cells, are capable of replicating human-like glycosylation patterns, crucial for the therapeutic efficacy of many drugs. Their prevalence reflects the current focus on high-potency biologics that demand advanced expression systems.

In contrast, non-mammalian systems are gaining traction as the fastest-growing source, largely because of their cost-efficiency and shorter production cycles. Yeast and bacterial systems are extensively employed in the production of vaccines, enzymes, and simpler recombinant proteins. Recent innovations have improved their ability to handle complex proteins, making them viable alternatives for certain biosimilars and therapeutic proteins. The ease of scalability, reduced contamination risks, and lower downstream processing costs are further accelerating their adoption among contract manufacturers targeting mid- and small-sized biotech clients.

By Service Insights

Process development is the cornerstone service of contract manufacturers, particularly because biopharmaceutical production requires customized optimization at both the upstream (cell culture, fermentation) and downstream (purification, filtration) levels. Upstream process development ensures high-yield, viable cell lines, while downstream efforts focus on maximizing product purity and minimizing impurities. Given the criticality of process reproducibility and compliance with cGMP (current Good Manufacturing Practices), demand for specialized development services remains robust across all stages of the product lifecycle.

Analytical and QC studies are the fastest-growing service segment, driven by the rising complexity of biopharmaceutical molecules and regulatory scrutiny. With evolving requirements for lot release testing, biosimilarity assessments, and stability studies, biopharma companies increasingly rely on specialized QC labs integrated into contract manufacturing setups. Services such as mass spectrometry, bioassays, and glycan analysis are becoming standard offerings. CMOs investing in high-throughput, AI-integrated QC platforms are gaining competitive advantages by reducing analytical bottlenecks in the product pipeline.

By Product Insights

Biologics represent the dominant product segment, supported by the surge in monoclonal antibodies, therapeutic proteins, and novel vaccines. From oncology to autoimmune diseases, biologics offer highly targeted mechanisms of action. Given their complex structures and specific delivery requirements, the majority of biologics are outsourced to manufacturers with bioreactor systems, analytical depth, and regulatory experience. Sub-segments such as monoclonal antibodies are particularly attractive due to their high market demand and premium pricing.

Biosimilars, however, are the fastest-growing product segment, driven by the wave of patent expirations and cost-containment pressures in the U.S. healthcare system. Biosimilars are biologic products that are highly similar to FDA-approved reference drugs, and while their development remains capital-intensive, they offer a compelling market proposition due to reduced R&D costs. CMOs that can offer biosimilar-specific manufacturing services especially those with track records in comparability studies and clinical batch production are seeing increasing demand from both domestic and international clients seeking U.S. market entry.

Country-Level Analysis

The U.S. remains the largest and most strategically significant market for biopharmaceutical contract manufacturing due to several interrelated factors. The presence of a highly regulated environment, the FDA’s evolving guidance on biologics and biosimilars, and a mature ecosystem of innovation hubs (Boston, San Diego, Raleigh-Durham) create a fertile ground for outsourcing partnerships. Additionally, U.S.-based CDMOs are increasingly aligned with government initiatives aimed at bolstering domestic drug manufacturing capacity in the face of global supply chain vulnerabilities.

Public-private partnerships, along with venture capital funding in biotech startups, continue to fuel demand for flexible and scalable manufacturing capabilities. In parallel, U.S.-based CMOs are enhancing their service portfolios to cater to cell therapies, nucleic acid-based drugs, and vaccines—a strategic pivot highlighted by the COVID-19 response. Furthermore, regulatory agencies in the U.S. are actively supporting technology transfer programs to expedite approvals, especially in areas of unmet medical need, encouraging biopharma innovators to seek domestic production support.

Recent Developments

-

March 2025 – Thermo Fisher Scientific announced the expansion of its biologics manufacturing facility in North Carolina to increase cell culture capacity for monoclonal antibody production. This development highlights the strategic shift toward investing in domestic infrastructure to meet rising demand.

-

January 2025 – Catalent partnered with a leading RNA-based therapy developer to scale up mRNA production using its proprietary encapsulation technology. This reflects the rising importance of RNA therapeutics in the outsourced manufacturing sector.

-

February 2025 – Samsung Biologics confirmed its plan to establish a U.S.-based production site, marking its first manufacturing footprint in the country and aligning with the trend of global CDMOs establishing closer proximity to U.S. clients.

-

April 2024 – Lonza Group launched a digitalized analytics platform integrated into its U.S. QC labs to reduce batch release timelines and improve regulatory reporting accuracy.

Key U.S. Biopharmaceuticals Contract Manufacturing Companies:

- Lonza

- WuXi Biologics

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Boehringer Ingelheim

- Thermo Fisher Scientific Inc.

- Samsung BioLogics

- AGC Biologics

- Catalent Pharma Solutions

- Rentschler Biopharma SE

- Eurofins Scientific SE

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Biopharmaceuticals Contract Manufacturing market.

By Source

By Service

- Process Development

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

By Product

- Biologics

- Monoclonal antibodies (MABs)

- Recombinant Proteins

- Vaccines

- Antisense, RNAi, & Molecular Therapy

- Others

- Biosimilar